|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

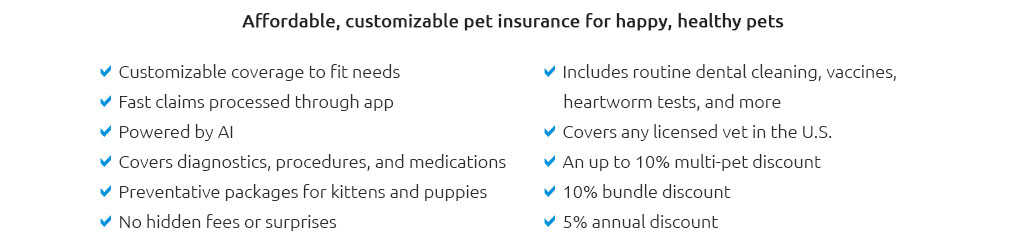

Understanding Pet Insurance That Pays Upfront: A Comprehensive GuideWhen it comes to ensuring the well-being of your furry friends, pet insurance that pays upfront can be a game changer. Not only does it alleviate the financial burden, but it also ensures that your pet receives timely care. In this article, we will explore what this type of insurance entails, its benefits, and common mistakes to avoid. What is Pet Insurance That Pays Upfront?Pet insurance that pays upfront refers to policies where the insurer directly pays the veterinary clinic instead of reimbursing the pet owner after they have settled the bill. This approach can significantly reduce the financial stress associated with unexpected pet health issues. Benefits of Paying Upfront

Common Mistakes to AvoidWhile opting for upfront payment insurance seems beneficial, there are common pitfalls that pet owners should be cautious of. Choosing the Wrong PlanIt’s essential to select a plan that matches your pet’s specific needs. For instance, if you own a best pet insurance for mini goldendoodle, ensure the policy covers breed-specific conditions. Ignoring the Fine PrintPolicies often come with exclusions and limitations. Make sure to read the terms and conditions carefully to avoid unexpected surprises. Overlooking Network RestrictionsSome insurance plans may require you to visit specific veterinary networks. Verify whether your preferred vet is included in the network to ensure seamless service. How to Get Started with Pet Insurance

Frequently Asked QuestionsIs upfront payment insurance more expensive?Not necessarily. While some plans may have higher premiums, the immediate coverage benefits can outweigh the costs, especially in emergencies. Can I switch to an upfront payment plan anytime?Switching plans is possible, but it may involve waiting periods and new underwriting. It’s best to consult with the insurer for specific details. Pet insurance that pays upfront is an excellent option for pet owners seeking convenience and financial ease. By understanding the terms, avoiding common mistakes, and choosing the right plan, you can ensure your pet’s health is never compromised. https://www.trupanion.com/pet-insurance/veterinarians

The benefits of VetDirect Pay. The days of waiting to be reimbursed hundreds, if not thousands, of dollars are over! We pay your bill for you directly at ... https://www.aflac.com/individuals/products/pet-insurance.aspx

Trupanion takes a different approach - they are the only pet insurer that can pay your veterinarian3 directly at checkout. Watch Video . Pet Insurance Coverage ... https://www.reddit.com/r/AskVet/comments/1dtozwq/which_pet_insurance_pays_upfront_for_your_pets/

I know that there is a pet insurance that does make payments upfront so that you don't need money to pay upfront because they do it for you and get your pet ...

|